Credit Utilization is 30% of your FICO score Add up to 165 points optimizing Amount Owed correctly

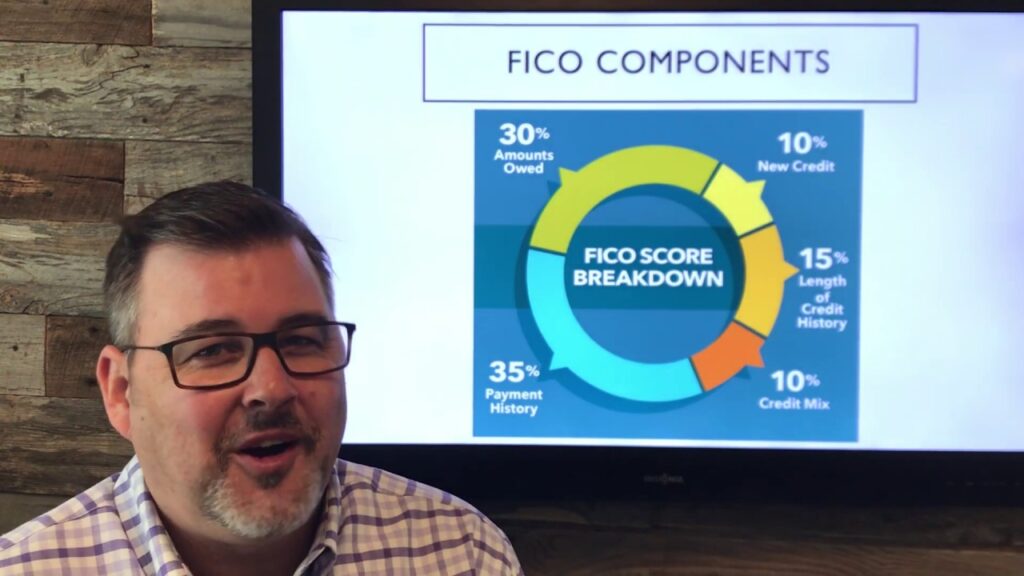

Credit Utilization is 30% of the FICO credit score that all mortgage lenders and banks use to determine credit approval for a mortgage. When used together with Credit Mix and New Credit it represents 50% of your overall score. When you optimize Credit Utilization and lower the use of your credit cards to 10% or less of your overall limit FICO adds points to your score. Call Mortgage Credit Pro at 469-500-5906 or visit www.mortgagecreditpro.com to learn how to improve your score and schedule a FREE 30 Minute Credit Audit of your credit report.